Scammers Exploiting Fake Celebrity Ads Con Millions in Fraudulent Crypto Schemes

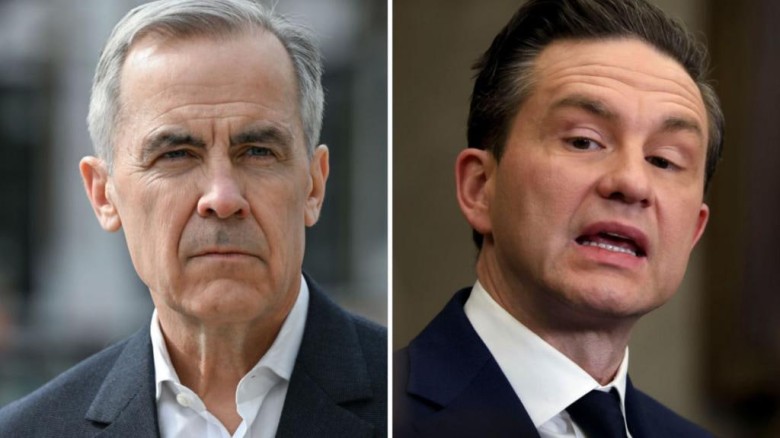

An organized fraud network based in Georgia has deceived thousands of savers across the UK, Europe, and Canada, swindling them out of $35 million (£27 million) through fake celebrity advertisements on Facebook and Google. These deceptive ads, featuring deepfake videos and fabricated news reports of well-known personalities like Martin Lewis, Zoe Ball, and Ben Fogle, were used to lure victims into fraudulent cryptocurrency investment schemes.

Despite government pledges to clamp down on such scams three years ago, the fraudsters continued their operations, even contacting victims in recent weeks. The UK bore the brunt of the scam, with British victims losing approximately £9 million, accounting for a third of the total stolen funds.

Uncovering the Fraud Network

The large-scale scam was exposed through a massive leak of call center data obtained by Swedish public broadcaster SVT and shared with the Organized Crime and Corruption Reporting Project (OCCRP), the Guardian, and other investigative partners. The leaked data, which includes over one million recordings, provides a rare glimpse into the devastating impact of the scam and raises concerns about the effectiveness of governments, banks, and tech firms in preventing such frauds.

The fraud operation was run from three office buildings in Tbilisi by a group of approximately 85 call center agents. Internally referring to themselves as "skameri" (Georgian for scammers), these agents targeted pensioners, employees, and small business owners, convincing them to transfer vast sums from their savings accounts.

Since May 2022, the network has reportedly conned around 6,000 people worldwide, with nearly half of their attempted scam calls directed at UK phone numbers. Among the 2,000 victims who suffered the most significant financial losses, 652 were from the UK.

Victims Devastated by the Scam

One victim, a former NHS doctor in her 70s living in sheltered housing in London, spent over 55 hours on the phone with scammers. In a heart-wrenching call, she pleaded, “I’ve used up every penny of my savings. I have nothing. And I can’t survive like that.” She lost approximately £50,000 and reportedly passed away shortly after her last contact with the scammers in the summer of 2023.

Another victim, a retired London Stock Exchange employee, was the most frequently contacted UK target, spending over 135 hours on the phone and ultimately losing more than £162,000.

How the Scam Operated

The fake advertisements, which often referenced billionaire Elon Musk, were placed by affiliate marketers who earned commissions for gathering contact details of potential victims. The fraudsters pressured victims into opening accounts with digital banks such as Revolut, Chase, and Kroo to facilitate transactions. Revolut appeared most frequently in the leaked data, with 119 of 403 listed UK victims using its services. Kroo was linked to 50 victims, while Chase was associated with 14 cases.

Revolut, which received a UK banking license last year, reported that 60% of all scam cases it handled in 2023 originated from Meta-owned platforms like Facebook and WhatsApp. The company criticized social media firms for failing to warn users or reimburse victims.

Calls for Greater Action

Prominent figures such as Fogle, Lewis, and Ball have spoken out against the fraudulent use of their images in deepfake scams. Lewis previously took legal action against Facebook in 2018 after the platform hosted numerous fake investment ads using his name. The lawsuit was dropped after Facebook agreed to donate £3 million to an anti-scam initiative with Citizens Advice and introduced a UK-specific reporting tool.

UK MP Chi Onwurah, chair of the Commons Science, Innovation and Technology Committee, highlighted the need for urgent action. She stated that their ongoing investigation into online misinformation had exposed significant weaknesses in the Online Safety Act, particularly regarding AI threats and fraudulent advertising.

The UK government emphasized that scamming is a criminal offense and urged social media companies to prevent their platforms from facilitating such fraudulent content. A Meta spokesperson defended the company’s stance, stating that scam-related ads violate its policies and highlighting its Fraud Intelligence Reciprocal Exchange (FIRE) program, which aims to help banks and financial institutions share fraud-related information.

Google, which also hosted many of the fraudulent ads, reiterated its commitment to user safety, asserting that it enforces strict policies against misleading advertisements and removes any violations it finds.

Conclusion

While governments and tech companies acknowledge the threat posed by online scams, the scale of this fraud highlights the ongoing vulnerabilities in digital advertising and online security measures. With fraudulent advertising provisions in the Online Safety Act set to take effect only next year, many fear that scammers will continue to exploit loopholes, leaving thousands of savers at risk of financial ruin.

Leave A Comment